Secure. Innovative. Future-Ready.

Reduce risk, improve customer experiences, and stay ahead of evolving regulations — all while positioning your institution to lead in the next generation of secure, customer-centric digital financial services.

Open finance is non-negotiable

Financial institutions relying on outdated credential-based access face rising security risks, growing system strain, and accelerating customer attrition. Without modern open finance solutions, they struggle to deliver the secure, seamless experiences today’s customers increasingly expect.

Financial impact

Without modern open banking APIs, fintechs resort to outdated methods like screen scraping, which rely on credential sharing and increase the risk of compromise.

The average total cost of a financial data breach breach is now at 4.88 million. (IBM, 2024)

Customer impact

Customers expect easy, secure access to their financial data. Without open finance, frustrated customers may switch financial institutions to find more modern, secure, and easier to use experiences.

25% of customers switched banks last year in search of better digital experiences. (Salesforce, 2024)

Infrastructure impact

Without a secure open finance solution, financial institutions often see thousands of bot logins per customer per month, overwhelming legacy systems and leading to service disruptions.

Up to 51% of a bank’s online traffic can come from bots and screen scraping. (Imperva, 2025)

Open finance readiness assessment

How prepared is your financial institution?

Quickly gauge your financial institution's open finance readiness level.

How Akoya helps financial institutions

Akoya empowers financial institutions to modernize data access with a secure, API-first platform that does more than meet regulatory requirements — it transforms how you serve your customers. By giving consumers control, ensuring transparency, and eliminating outdated systems, Akoya helps you mitigate risk, drive efficiency, and unlock new opportunities for growth and innovation.

Give customers control and transparency

Akoya’s Open Finance Solution gives consumers full control and transparency over their data sharing. Through secure, API-based connections and white-labeled consent tools, financial institutions can empower users to view, manage, and revoke data access at any time.

Data activation

Beyond compliance, Akoya empowers financial institutions with enhanced insights into their customers' data sharing practices for better analytics, smarter decision-making, and accelerated product innovation. With unified, API-accessible data across your ecosystem, you can unlock new use cases like personalized offers, enhanced credit models, and embedded finance experiences — all while keeping the focus on the consumer.

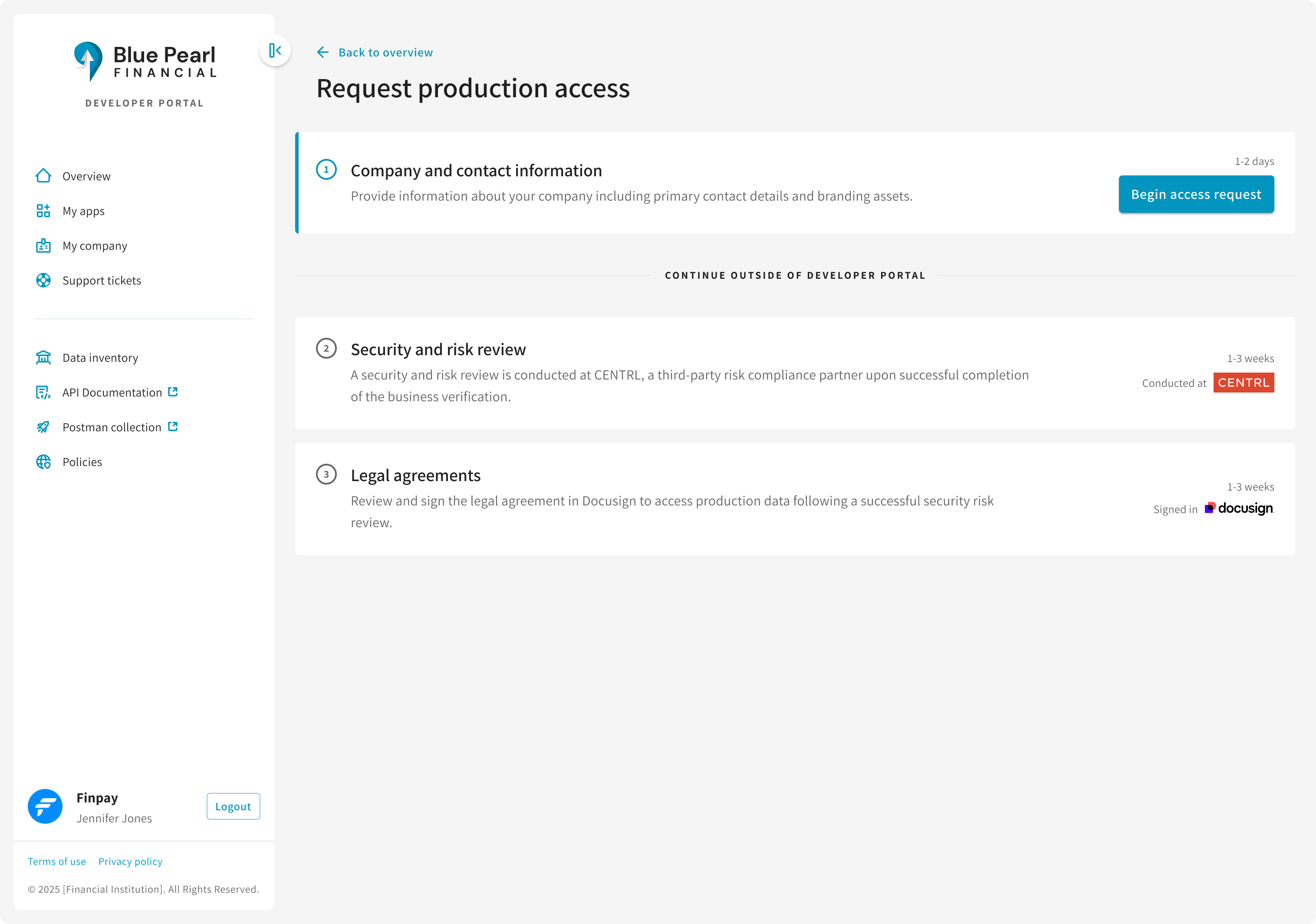

Third-party management

Akoya handles the heavy lift of onboarding, vetting, and managing third-party data recipients. We conduct ongoing security and risk assessments, manage data access agreements, and provide centralized support to reduce operational complexity. Our framework ensures your institution can maintain strict oversight of external parties, protect consumer data, and mitigate reputational and regulatory risks.

Future-proof compliance

Akoya’s turnkey solution is designed to meet current regulatory requirements, as well as allow financial institutions to adapt to future challenges and evolving standards. Our platform ensures consumer-directed, transparent, and secure data sharing practices, helping financial institutions avoid costly retrofits while building a future-ready open finance strategy that strengthens trust and brand reputation.

Give customers control and transparency

Akoya’s Open Finance Solution gives consumers full control and transparency over their data sharing. Through secure, API-based connections and white-labeled consent tools, financial institutions can empower users to view, manage, and revoke data access at any time.

Data activation

Beyond compliance, Akoya empowers financial institutions with enhanced insights into their customers' data sharing practices for better analytics, smarter decision-making, and accelerated product innovation. With unified, API-accessible data across your ecosystem, you can unlock new use cases like personalized offers, enhanced credit models, and embedded finance experiences — all while keeping the focus on the consumer.

Third-party management

Akoya handles the heavy lift of onboarding, vetting, and managing third-party data recipients. We conduct ongoing security and risk assessments, manage data access agreements, and provide centralized support to reduce operational complexity. Our framework ensures your institution can maintain strict oversight of external parties, protect consumer data, and mitigate reputational and regulatory risks.

Future-proof compliance

Akoya’s turnkey solution is designed to meet current regulatory requirements, as well as allow financial institutions to adapt to future challenges and evolving standards. Our platform ensures consumer-directed, transparent, and secure data sharing practices, helping financial institutions avoid costly retrofits while building a future-ready open finance strategy that strengthens trust and brand reputation.

Let Akoya manage the heavy lift

Akoya can handle the ongoing effort of managing third parties with ongoing risk reviews and contractual obligations for all data recipients based on your specific requirements and policies. Our fast and flexible approach reduces onboarding time while maintaining high security standards.

Managed security and risk reviews

Data access agreement services

24/7 high touch support

Akoya's Open Finance Solution

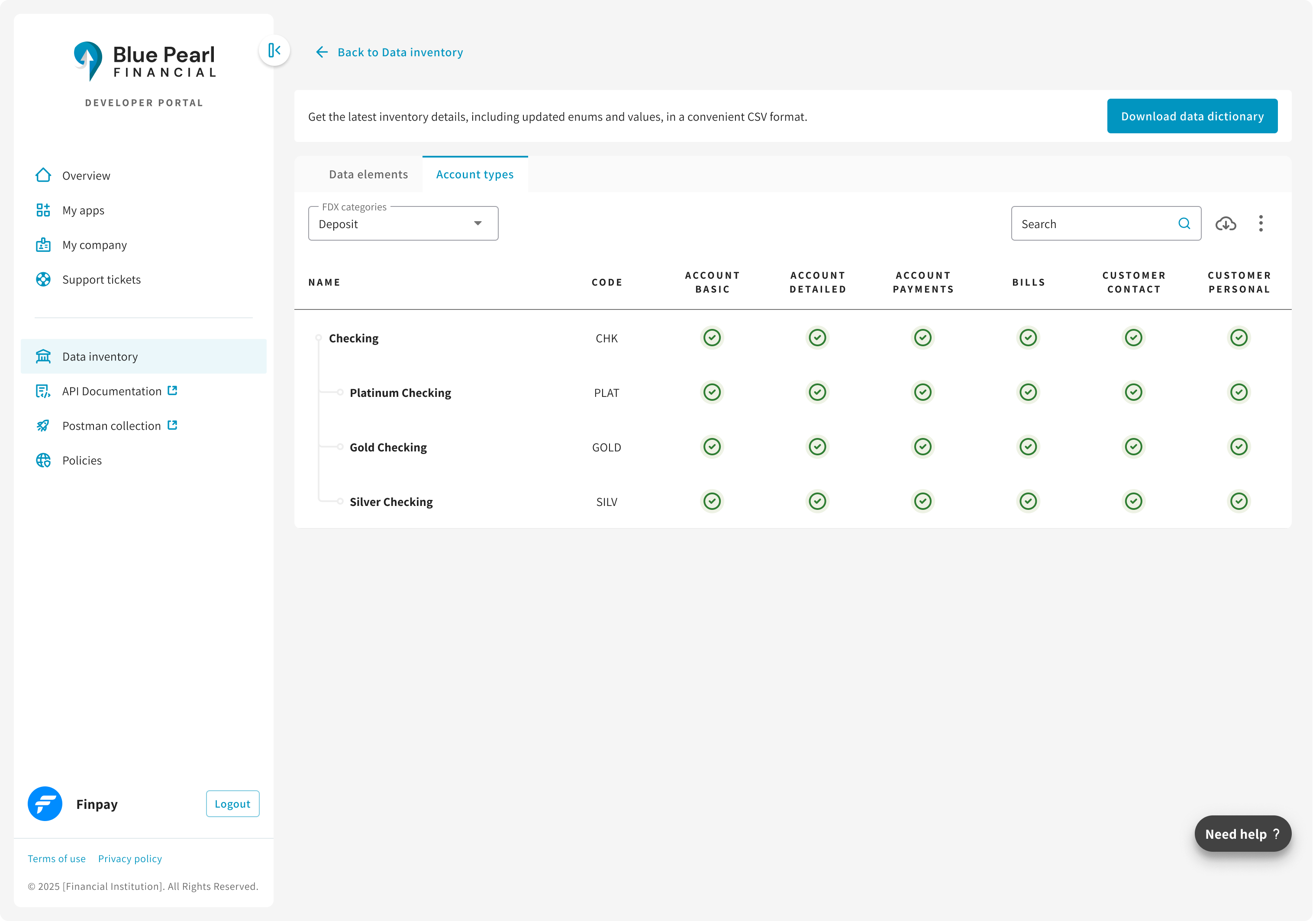

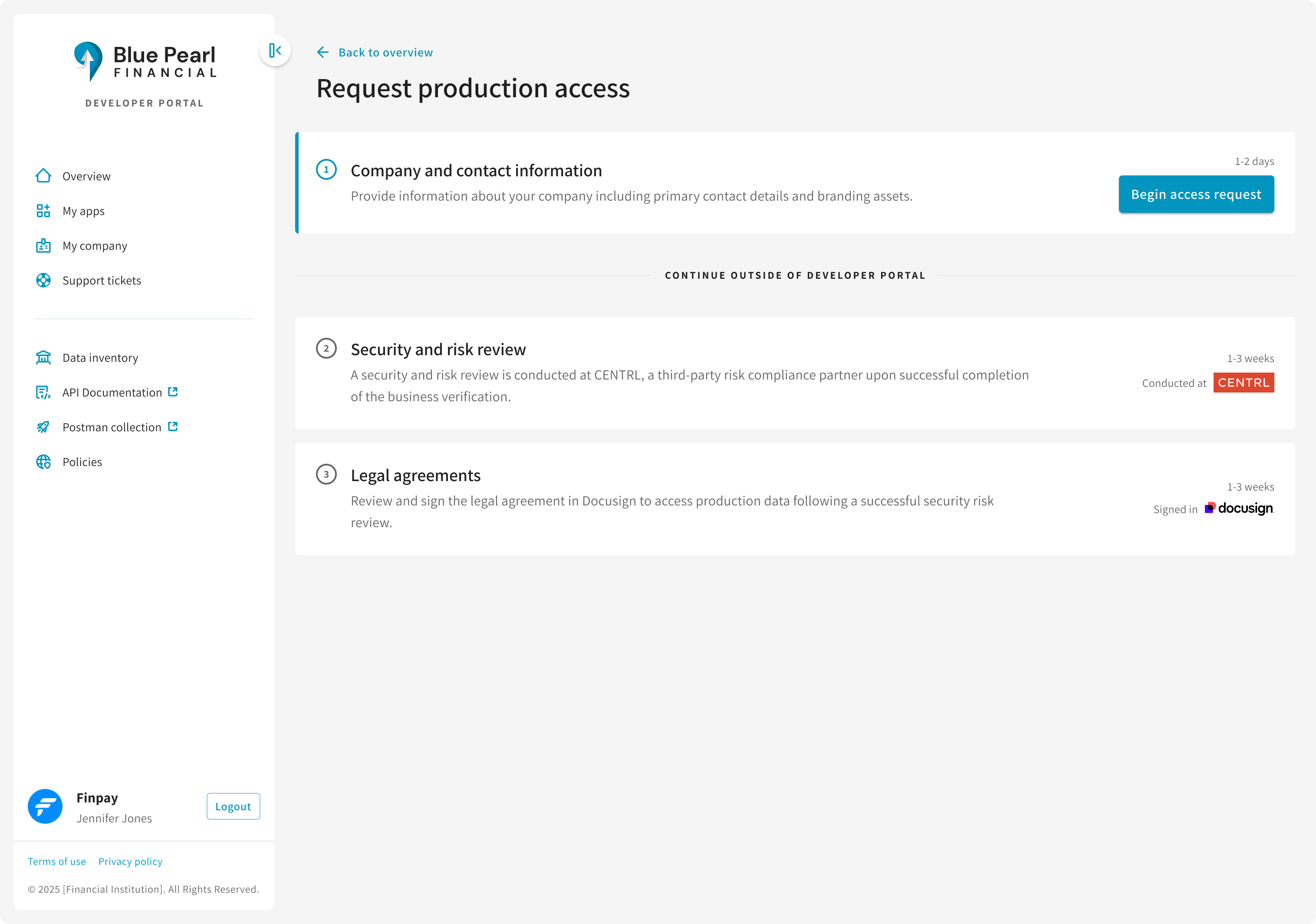

Developer Portal

Third parties can easily discover, test, and connect to your financial institution through a fully compliant, white-labeled developer portal. With self-service sign-up, access to standardized APIs, documentation, and a robust sandbox, data recipients can integrate quickly and securely.

- Secure, updated, access to FDX-compliant, standard and premium APIs

- Flexible implementation models, made to fit your unique tech stack

- Fully integrated support center

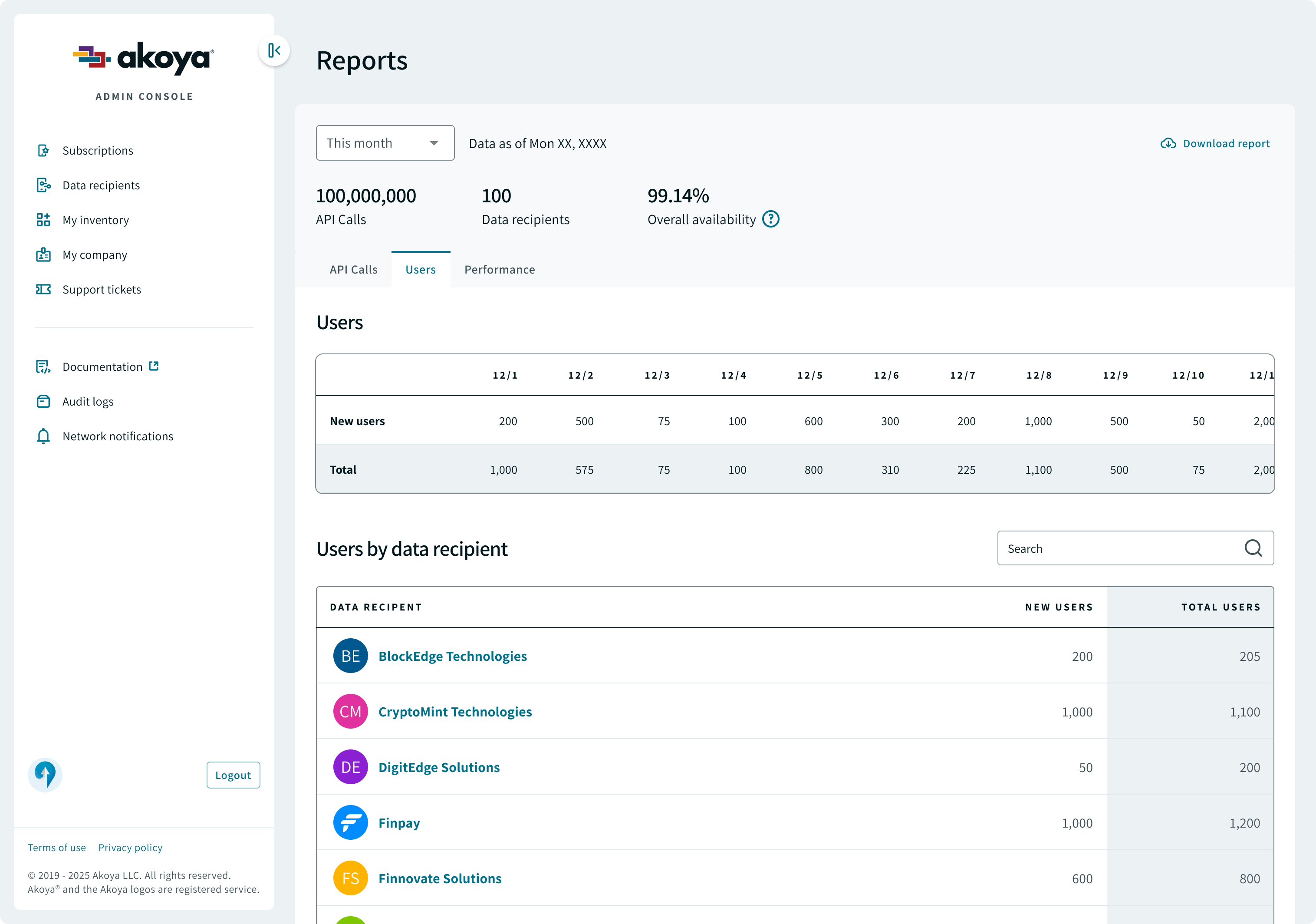

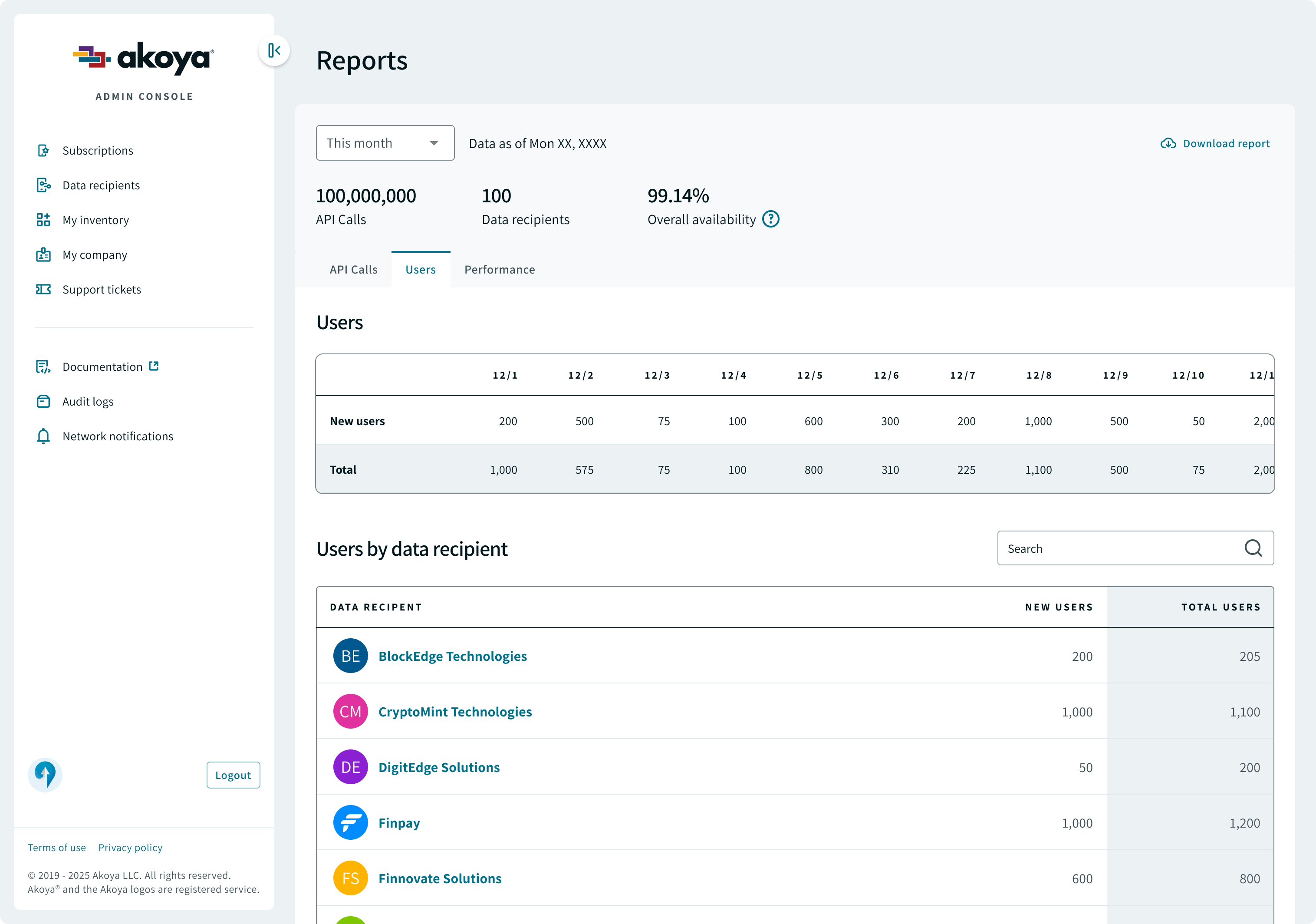

Admin Console

Financial institutions can seamlessly manage all third parties — reviewing due diligence, tracking contracts, monitoring support activity, and maintaining audit logs — from one secure, centralized platform. Gain visibility, reduce risk, and streamline oversight with ease.

- Built-in reporting to meter API usage, user volume, performance, and support tickets

- Easily manage all third parties

-

Insights into data sharing practices = providing opportunities for customer enhancements

Consumer Permission Dashboard

API-powered, white-labeled dashboard for consumers to visualize all the third parties they’ve authorized to access their data, broken down by each third-party app. Ability for consumers to review, add, and easily revoke consent at any time, directly from the financial institution’s mobile or online banking platform.

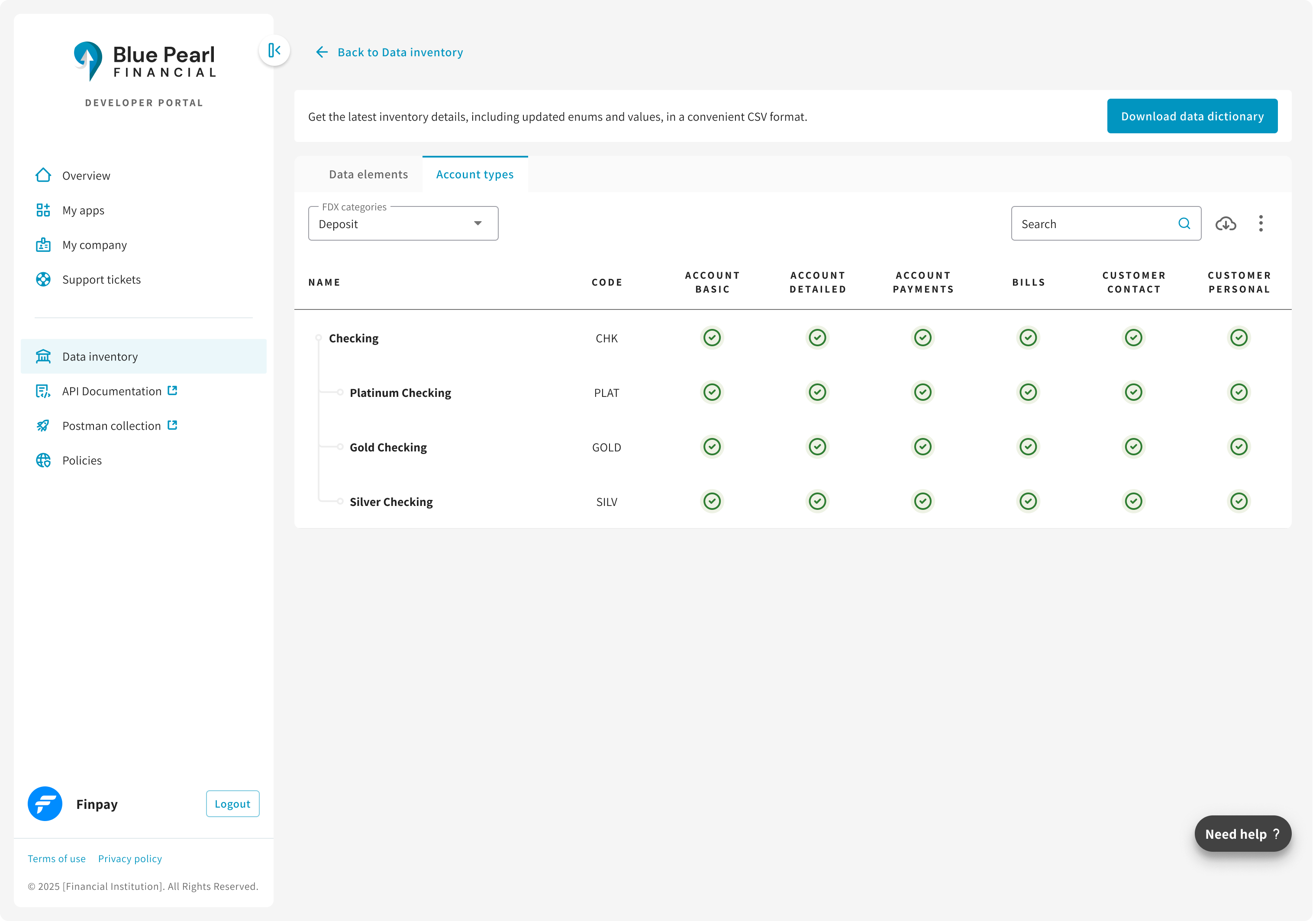

API Documentation

Ready-to-use, white-labeled documentation tailored to your financial institution’s brand. Akoya provides everything developers need — including branded guides, sample specs, test data, and test users — to ensure a fast, seamless, and secure onboarding experience.

Financial institutions trust Akoya

"TD has embraced the Akoya Data Access Network as a key enabler of our customer-driven banking strategy in the US market. This has allowed us to provide our customers with a safe and secure way to share their data with participating third-parties of their choice."

Franklin Garrigues, Vice President of External Ecosystems