For fintech companies trying to offer innovative payment services and options to consumers, relying on the ACH network feels archaic. And it is. The Automated Clearing House (ACH) was established in the late 60s and early 70s. The ACH network process large amounts of electronic fund transfer every day, processed in batches. The outdatedness of the network is further amplified when compared to other countries like Australia, Brazil, India, and the U.K. that are all operating successfully on instant payment rails.

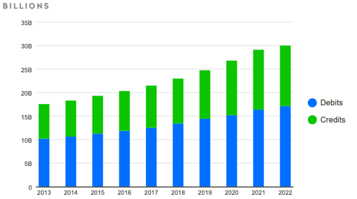

Yet, the ACH network is still the most used payment rail in the U.S. with a 3% YoY growth in payment volume in 2022, reaching 30 billion payments processed.

|

As the graph indicates, there are two main types of ACH transactions:

|

|

Funds can be electronically transferred both ways over ACH, which makes the network quite flexible and prime for more modern use.

The fact remains that the ACH network was designed over 50 years ago, leading to several challenges in today’s financial ecosystem. For example, the design relies on batch processing transactions, a constraint of technology at the time it was built, using mainframe servers. This means that funds are not exchanged, cleared, or settled in real-time – rather, during specific time windows throughout a business day. From a consumer’s point of view, it can take from one to three business days for a payment to be received, appearing as a lag in the processing time.

Drawbacks of legacy systems in the modern age

Today, many fintech companies enable consumers to use their bank accounts to make purchases directly, a method commonly referred to as ‘pay-by-bank'. There is an increase in demand for payment methods that utilize bank accounts instead of cards.

The lag in processing ACH payments poses a significant risk for merchants that typically ship goods when the checkout process has completed. The lag also introduces potential cashflow issues for merchants. With the ACH network, sufficient funds are not guaranteed and there is a risk of insufficient funds when the ACH transaction is debited from the consumer’s account.

The same constraints can also prevent companies from immediately funding new accounts while onboarding customers, leading to delays in the services rendered and poor customer experience.

Until recently, consumers and companies have learned to live and operate within these constraints. Advancements in more modern technologies have driven the desire for everything to be instantaneous, creating a gap in customer expectations and an increase in discontent. It becomes hard to cope with the fact that Amazon can ship goods to homes faster than banks can send money between two accounts. The good news is, we now see these ACH use cases improving – both for merchants and consumers.

Assessing ACH risks

With the advent and evolution of Open Finance, companies can now access real-time, consumer-permissioned data to enable better decision-making.

Akoya helps fintechs gain access to the data they need to overcome the risks of using ACH. Akoya’s Balances and Transactions products provide insight into consumer bank account balances and transactions histories.

A main hurdle of an ACH payment is the risk of bounce back. This happens when the balance of an account is less than the incoming ACH debit (resulting in a return code R01 – Insufficient Funds). This risk can be mitigated by creating a better understanding of the customer profile when compared to the purchase they are trying to make. This profile can be built on data from real-time balance and past transactions on the account. Internal risk engines can ingest these various data points to determine the likelihood of an ACH transaction to be successful.

Transaction histories can be used to identify patterns, such as income and recurring expenses. These patterns can then be looked at against a current account balance to estimate the likely future balance of an account when the ACH debit will hit the account. Depending on the size of the purchase, this can be enough to decide whether the purchase can go through.

Partnering with Akoya, fintech companies can address ACH constraints by offering merchants “guaranteed ACH” services. Risk engines can evaluate the likelihood of the ACH payment going through and, based on this, companies can offer merchants immediate access to funds instead of them having to wait business days.

The same approach can be used for many different use cases. Check out this quick video to see how Akoya empowers consumers to more efficiently manage their finances by giving them increased choice, control, and convenience.

Unlock instant ACH verification

In all the use cases looking to be powered by ‘pay-by-bank' like experiences, companies can leverage consumer-permissioned data to make better risk-based decisions. In scenarios like account opening, e-commerce purchases, or buy-now-pay-later services, improving risk-based decisions offers better user experiences.

Fintechs can now provide the immediate movement of funds to consumers in a world that still processes most of the transactions in batches.

More informed, data driven, decision making for ACH payments is only one piece of the ever-improving value chain. To see others, refer to some of my previous articles on account verification and ownership validation. Small improvements in the background can bring tremendous enhancements to your user experiences.