To address various commerce needs, the U.S. has a plethora of payment methods available. ACH (Automated Clearing House), Same Day ACH, cards, wires, checks – just to name a few. More recently, the U.S. added two new instant payments rails: The Clearing House’s Real-Time Payments (RTP) network and the Federal Reserve’s FedNow. The two newcomers are both very similar and offer irreversible push payments running with instant (within seconds) transfer and settlement times 24 hours a day, 7 days a week, 365 days a year.

The growing appeal of instant payments in the U.S.

The adoption of instant payment methods is growing significantly worldwide. The growth of instant payments in Europe and the deployment of similar services in the U.S. can be attributed to the value provided to merchants. For instance, paying by bank:

-

Eliminates payment processing fees (typically a high rate ~ 3% per transaction in the U.S. for credit).

-

Increases security of payments and allows consumers to authenticate using biometrics.

-

Increases consumer conversion reducing the number of failed transactions.

-

Increases consumer likelihood to complete another purchase.

-

Reduces the risk of charge backs and overall fraud.

-

Improves business cashflow.

-

Allows for merchants to expand their potential customer base.

At the same time, account-to-account payment methods offer an attractive value proposition to consumers directly. The adoption of these payment methods in Europe paved the way for similar adoption in the U.S. market. From a consumer benefit perspective, account-to-account payments:

-

Allow for a balance check before confirming a transaction, which helps consumers stay in control of their finances.

-

Provide a more seamless checkout experience for consumers by removing the need to have a card with them.

-

Increase payments security as all transactions are subject to bank grade security and authentication measures.

-

Reduce costs associated with owning a credit card.

Exploring solutions to better serve consumers and merchants

Akoya and Banked are exploring solutions to overcome current drawbacks and bring Pay by Bank : powered by instant payments to the U.S. market. They know that the solution must:

|

Be transparent to the end-user with explicit disclosures provided within the solution. |

Be consumer consent driven and be revocable by the consumer for any future transactions. |

Provide sufficient value for all parties (merchants, consumers, and financial institutions). |

Two main approaches:

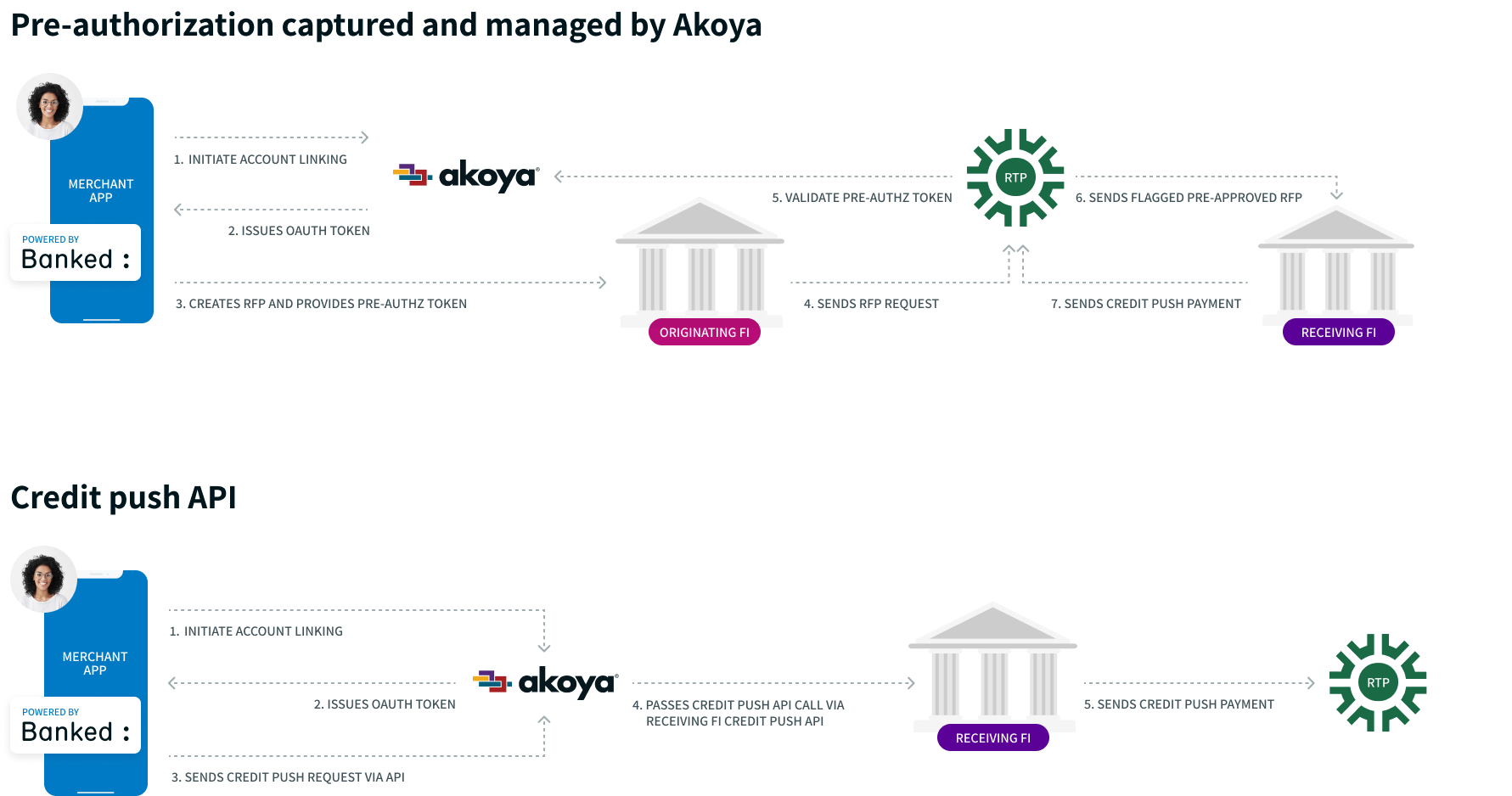

As of now, two main approaches are being investigated. The first consists of enabling a “pre- authorized” Request for Payment and the second relies on financial institutions providing instant payment APIs directly.

- In the "pre-authorized” Request for Payment scenario, Akoya can capture a consumer pre- authorization during the merchant account linking process. Akoya can then issue a pre- authorization to the merchant which can use it through Banked to initiate a Request for Payment and pass the pre-authorization over the RTP network. During the processing of the Request for Payment, the pre-authorization can be validated, and the consumer’s bank can automatically create a push payment.

- In the instant payment APIs scenario, financial institutions can decide to make APIs available to Akoya which would allow for triggering a push payment directly from the bank. Akoya can capture the consent during the merchant account linking process. The merchant, through Banked, initiates a consumer-approved push payment which in turn is sent to Akoya. Akoya sends the push payment request to the consumer’s bank via instant payment APIs with the specific parameters. Both alternatives result in the push payment being sent to the merchant without requiring the user to provide a manual approval. This is because the user already approved the payment during the account linking process.

In either approach, the combination of the Akoya and Banked networks provides strengthened security to the ecosystem. Akoya network recipients are thoroughly vetted with third party risk review processes following the same rigor and requirements as the banks. This creates a closed ecosystem in which all participants are known. Furthermore, the consumer authenticates and authorizes transactions using the bank systems.

Keep reading - register below to access the full whitepaper:

![]()

Banked is the architect of a new global payment network offering a real alternative to the card schemes. Consumers now have a way to pay without entering financial data and connecting directly with their mobile banking app. There is no need to create an account, no financial details are shared, authorization is biometric, and the merchant receives the funds in real-time and in full. Fees are up to 90% lower than the traditional payment methods and fraud is virtually eliminated, which should help promote lower prices for consumers. Banked also enables businesses to drive customer engagement and loyalty with incentives and rewards integrated into the payment experience. To learn more, visit www.Banked.com.